How to Find Net New Equity

Liabilities 500000 800000 800000 21 million. Net income for a period will be the change in equity during that period.

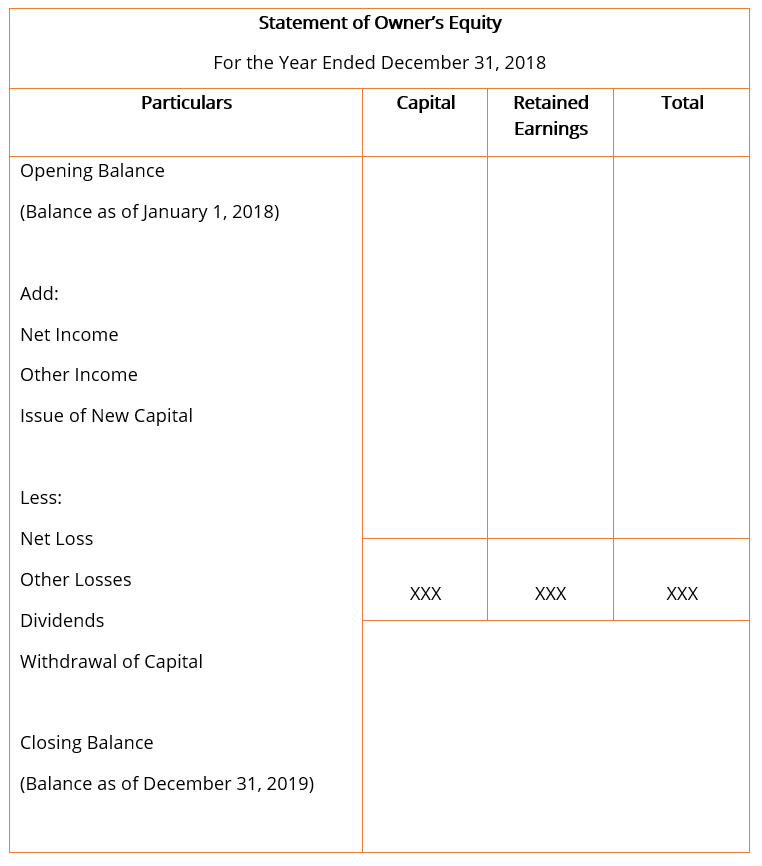

Equity Statement Definition Accounting Equation Line Items

Profits increase stockholders equity so when working backwards we must subtract them to move from ending to.

. 600 First we do the same familiar step -- subtract the beginning period equity of 500 from the ending period equity of 600 to get a 100 increase in equity. Net Equity Value enterprise value cash and cash equivalents short and long term investments short term debt long term debt minority interests. Table 4 Companys valuation considering that.

Net assets or net asset value NAV is a companys total assets minus its total liabilities. The derived amount of total equity can be used by lenders to determine whether there is a sufficient amount of funds invested in a business to offset its debt. As shown below.

The net new equity is found by this. Ie common stock additional paid-in capital retained earnings and treasury stock. Nominal g and Net Invest equity is calculated based on Expression 7 from nominal g.

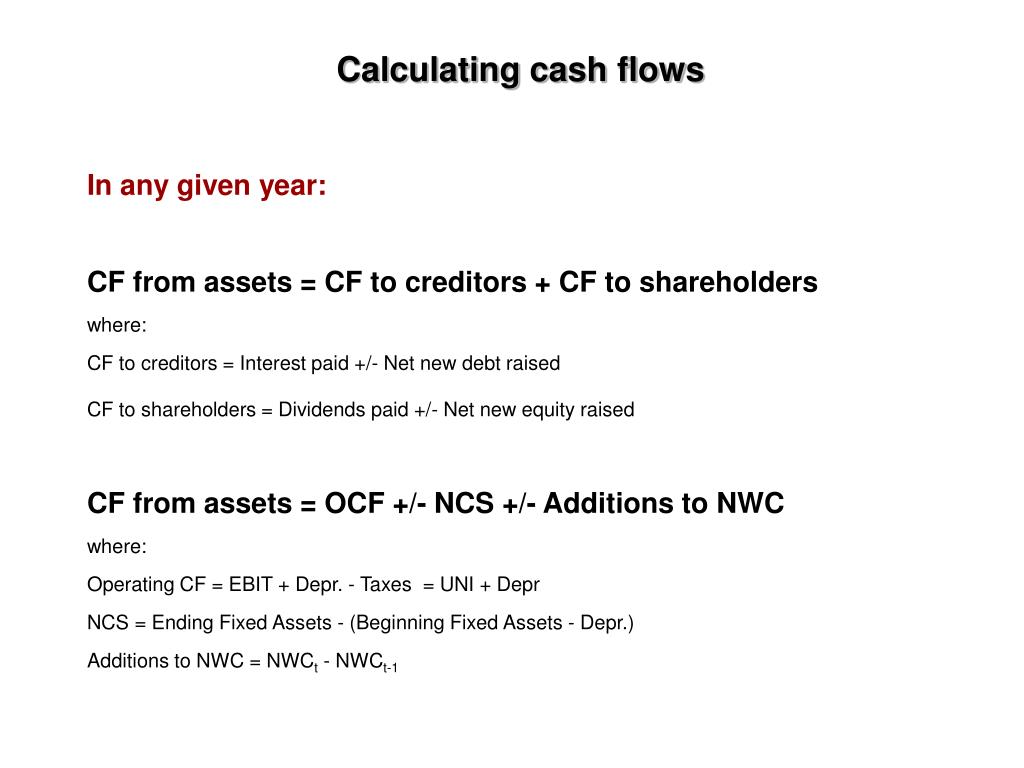

Assets - Liabilities - Owners Equity Net Income This is an adjustment to the Accounting Equation of Assets Liabilities Equity. To get to net income we. Here is another way of defining cashflows that is sometimes used for project valuation.

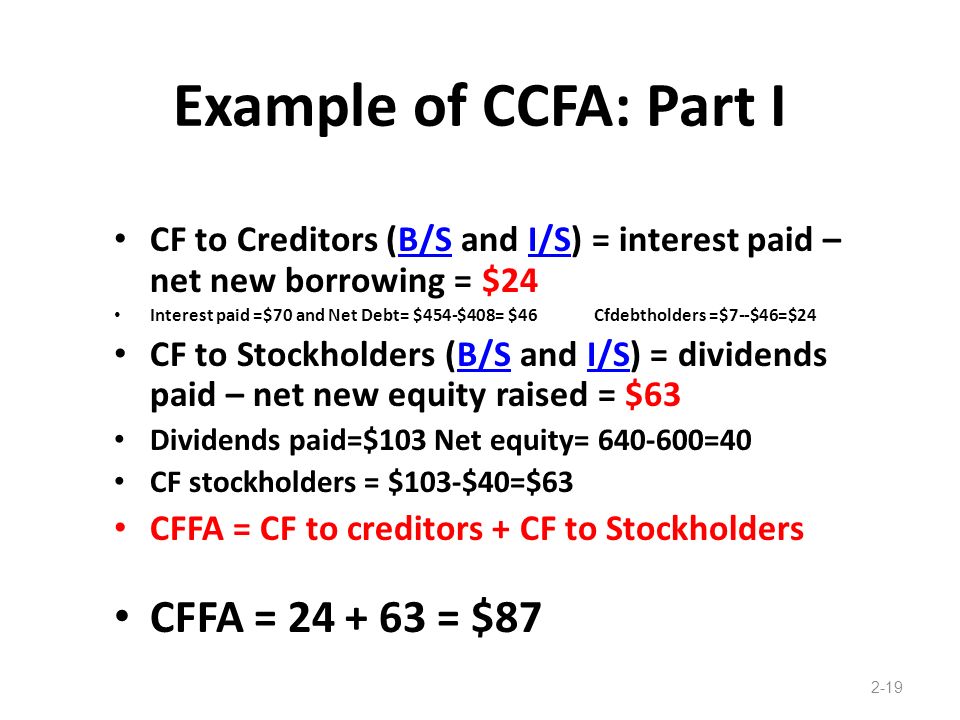

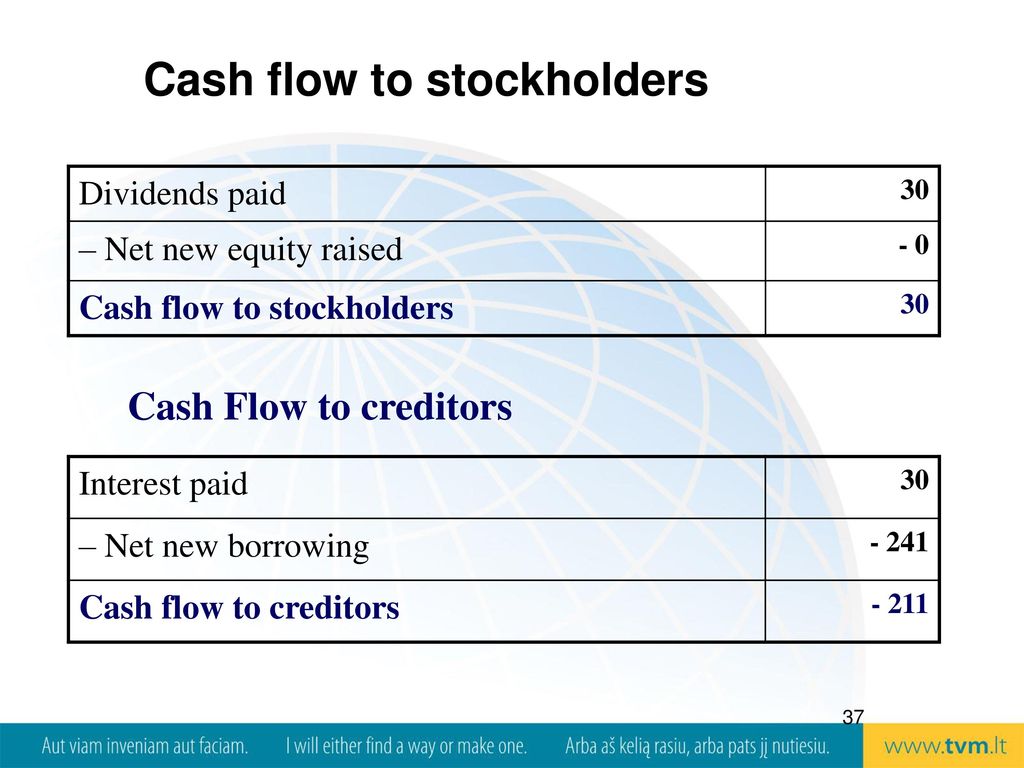

Together with other real estate financial terms like cash flow and appreciation home equity plays an important role in your real estate investing careerTo learn more about real estate equity and how you can use it to build your real estate investment portfolio read this. How to calculate net new equity Alternative Method of Defining Cash Flows used in Ross Westerfield and Jordan. Furthermore how do you find the net income on a balance sheet.

Why Net Equity Value is Important to Small Businesses. Net Working Capital Current Assets - Current Liabilities Yes there isnt much more to the working capital calculator. Where an independent retail store may calculate net assets on a quarterly or biannual basis an.

Net Sale Proceeds means for any sale or other disposition of assets the gross cash proceeds including any cash received by way of deferred payment pursuant to a promissory note receivable or otherwise but only as and when received received from such sale or other disposition of assets net of i reasonable transaction costs including without limitation any. Begin aligned text Debt to Equity Ratio frac. The calculation of its total equity is.

Firstly bring together all the categories under shareholders equity from the balance sheet. But if you want to know what to include in Current Assets and Current Liabilities see the following section. Assets - Liabilities - Owners Equity Net Income The accounting equation.

Enterprise Value EV Enterprise Value or Firm Value is the entire value of a firm equal to its equity value plus net debt plus any minority interest. Net income total revenue - total expenses. Lucky he worked out his net income before committing to that.

Owners equity Assets Liabilities. 750000 Assets - 450000 Liabilities 300000 Total equity. Add the 2006 Common Stock account and the additional paid in surplus together.

Identify the stockholders equity balance at the beginning of the period and the amount of new stock issued in the Total column of the statement of. How to Calculate Shareholders Equity The formula for calculating shareholders equity is. Therefore owners equity can be calculated as follows.

Assets Liabilities Equity. The Net Equity Value Equation. Banks use net equity value to determine the financial health of a company.

Assets Liabilities Equity can be rewritten to. The difference between the Balance Sheet Accounts will equal the difference between the Income Statement Accounts which is Net IncomeSince Owners Equity is only part of Total Equity Net Income can also be calculated using a rewrite of the Accounting Equation. Net Fixed Assets Formula Total Fixed Asset Purchase Price capital improvements Accumulated Depreciation Fixed Asset Liabilities The liabilities related to fixed assets are removed to know the actual net assets that the company owns.

To calculate debt-to-equity divide a companys total liabilities by its total amount of shareholders equity as shown below. Then add the 2007 common stock account and the additional paid in surplus. If you are new to the real estate investing world then you might have heard of real estate equity.

Net income 1800. The calculation of net assets varies by company. First we subtract the 200 of net income from period-end stockholders equity.

Net income 62000 - 60200. Total assets are what a company owns. When determining whether or not to underwrite a.

Net working capital formula To do a net working capital calculation you can use the following simple formula. To calculate equity value from enterprise value subtract debt and debt equivalents non-controlling interest and preferred stock and add cash and cash equivalents. The new fund purchased a portfolio of approximately 12 billion of private equity and venture capital assets with funded and unfunded commitments totaling 12 billion from MetLife affiliates as.

How to Use Total Equity. Then add up all the categories except the treasury stock. For this purpose it is necessary to separate cashflows into flows generated by the assets of the business and the cashflows flowing out of the firm to the holders of the firms.

Begin aligned text Shareholders Equity text Total Assets -. It can also be used by investors to see if there is a sufficient amount of equity. As a result net assets are often equated to a companys total shareholders liability.

Assets 1000000 1000000 800000 400000 32 million. Well it doesnt look like Gareth can afford that assistant just yet in spite of the healthy-looking 62000 revenue.

:max_bytes(150000):strip_icc()/phpdQXsCD-204ee8d463444c6c90f775fd179810f3.png)

How Do You Calculate A Company S Equity

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

The Statement Of Stockholders Equity Youtube

Financial Statements Taxes And Cash Flow Ppt Download

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Lbo Modeling Test Example Street Of Walls

Return On Equity Roe Formula And Excel Calculator

Free Cash Flow To Equity Fcfe Formula Examples Calculation Youtube

Topic 2 Financial Statements And Cash Flow Ppt Download

Solved 1 Operating Cash Flow 2 Cash Flow From Assets 3 Chegg Com

Ppt More On Firm Valuation Powerpoint Presentation Free Download Id 3015362

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Reporting And Analyzing Equity Boundless Accounting

Solved As A Soon To Be Business Baccalaureate From Indiana Chegg Com

What Is The Return On Shareholders Equity Ratio Bdc Ca

6 1 Chapter 2 Financial Statements Taxes And Cash Flow Financial Statements Taxes And Cash Flow Ppt Download

Comments

Post a Comment